CRISIL has enhanced the rated amount on Ecoplast while affirming 'BBB-/Negative' on the bank facilities and fixed deposits. The rated amount enhanced to Rs 215 million from Rs 129 million for total bank loan facilities.

CRISIL's ratings continue to reflect the Ecoplast group's moderate financial risk profile, marked by comfortable gearing, established position in the domestic plastics packaging business, and diversification into industrial films, such as aluminium composite films (ACP) and surface protection films (SPF). These rating strengths are partially offset by the Ecoplast group's moderate scale of operations and presence in the highly fragmented packaging industry.

CRISIL's ratings continue to reflect the Ecoplast group's moderate financial risk profile, marked by comfortable gearing, established position in the domestic plastics packaging business, and diversification into industrial films, such as aluminium composite films (ACP) and surface protection films (SPF). These rating strengths are partially offset by the Ecoplast group's moderate scale of operations and presence in the highly fragmented packaging industry.

CRISIL believes that Ecoplast group's accruals are likely to be under pressure resulting in deterioration of debt protection metics. The ratings may be downgraded if the group's liquidity comes under pressure with lower accruals result in further weakening of its debt protection metrics. Conversely, the outlook may be revised to 'Stable' if the group is able to achieve higher than expected sales and profitability resulting in improvement in overall financial risk profile.

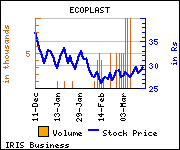

Shares of the company gained Rs 29.5, or 1.90%, to trade at Rs 0.55 at the BSE (12.08 p.m., Thursday).